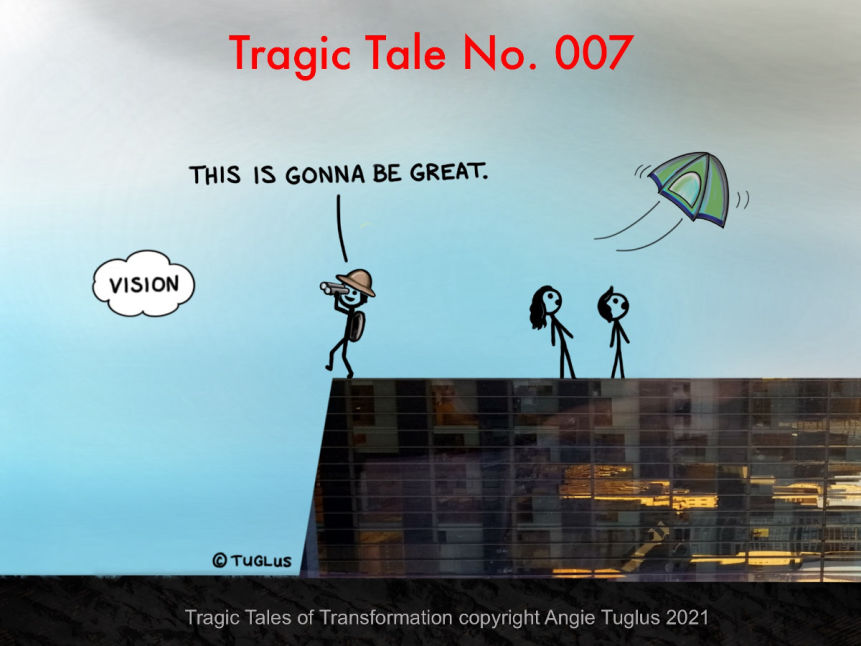

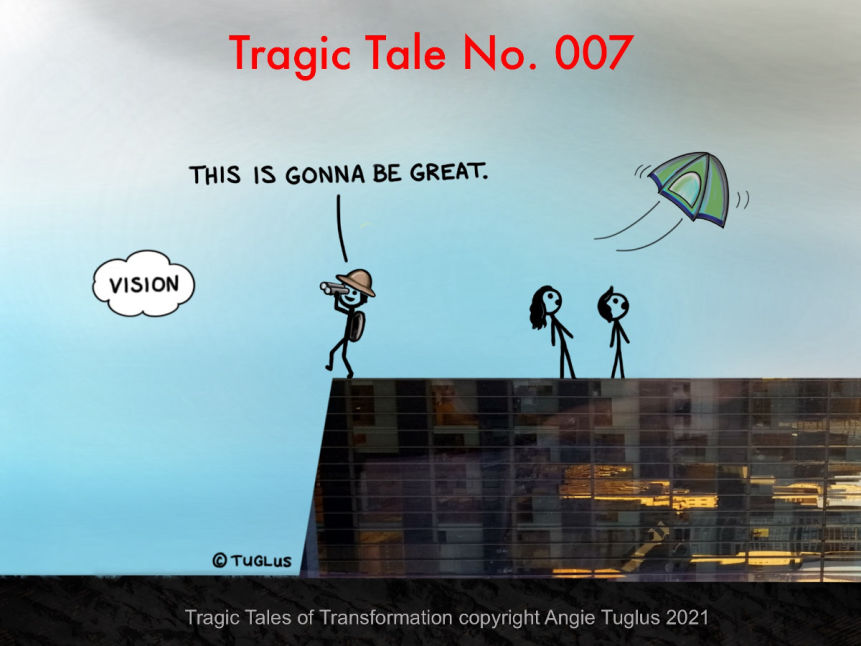

Tragic Tale No.007

An organically growing, highly distributed finance company in India fails to transform its operating model…

An organically growing, highly distributed finance company in India fails to transform its operating model…

This is the seventh in a series of tragic transformation tales, shared by a diverse group of business leaders, in conjunction with the launch of Angie’s book, TransformAble: How to Perform Death-Defying Feats of Business Transformation.

Today I’m talking to Anu George, a global business transformation leader, as she revisits a tragic attempt at transformation from her past.

Angie: Anu, you have an interesting tale of a growing company that takes on an operating model transformation. Tell me about it.

Anu: A number of years ago, I became head of operations for a consumer finance business in India. We were a rapidly growing, extremely distributed consumer financial services organization. We wanted to create process, controllership and consistency where there had been none, and reduce the risk of fraud and waste. So, we set out to transform the operation into a hub and spoke model, where the hubs would house the centralized operations and risk management, and the spokes would be purely sales and origination centers.

Angie: A very logical vision. Any organization growing organically though constantly opening new locations is challenged to get consistency, quality, and repeatability from their operations.

Anu: It was a great vision. Unfortunately, in the end we failed to achieve it, and instead wasted a year that didn’t lead to any results. Even though I had support from the Group CEO.

Angie: I’m intrigued. What happened?

Anu: We were growing rapidly and organically. When a new market geography was identified, we would just stick 3 or 4 employees there without any process. Then we would start generating business in those locations. We celebrated sales achievements, but after a few months, we would start seeing our bad debts rise in those locations.

Angie: Did you know why bad debt was increasing?

Anu: Everything was extremely manual and paper based. There were numerous opportunities for fraud, bad credit assessment, bad loans. That absence of controls, especially in a consumer finance business, was like running a ship with a big hole in it.

Angie: With profits leaking out the bottom.

Anu: Exactly.

Angie: The new hub & spoke operating model would mitigate the risk of bad loans?

Anu: Not only that. It would allow us to provide a more consistent and predictive service to customers—a better customer experience.

Angie: Nice. Multiple benefits. How did you set out to achieve this?

Anu: We mapped all our offices—about 40 of them—and grouped them into 4 geographic regions. Each region would have a central hub, and each of the smaller offices would be linked to a hub. We planned to introduce scanning technologies and workflows to digitally connect the spokes with the hubs in a seamless way. Underwriting, risk management, and operations management would all be housed centrally. Those tiny 40 dots on the map would become the sales originating spokes.

Angie: So, what happened next? Sounds like you had a clear vision and a plan.

Anu: Well, the best plans come to naught if you do not have the support behind them. And that is exactly what happened. I was all gung-ho about the plan, and started working with my team to execute it. We began looking for scanning solutions and workflow solutions, we picked the hub locations, we mapped the spokes to the hubs, and started planning the new organizational structure.

I shared the plan with my CEO and my peers—the CFO, the head of risk, the head of sales... I got the initial nods, and off I went. But as things progressed, I started getting a ton of questions. Or worse—in some cases—radio silence. Gradually, it became clear that I did not actually have the support I needed. The CEO was behind it. But he was in a transition. The head of risk was an expatriate, and in India only for a short stint. The head of sales quit soon after, which perhaps explained why he was not keen.

Angie: In my book, I talk about how both know-how and commitment are critical to successful business transformation, and must be maintained throughout the entire transformation for success. No matter how much transformation know-how you have, if commitment drops too low, you hit the failure zone. It sounds like you hit that. None of your peers were on board?

Anu: No, they weren’t. But I couldn’t see any of it. I was so inspired by the vision I had. It was such a great vision. I couldn’t see that I didn’t have any buy-in from my peers. I was emboldened by my Group CEO’s support. But that wasn’t enough.

Angie: You were running after that great vision and your team was starting to execute the plan. It’s easy to get caught up in the activity of transformation, and to miss the need to nurture commitment. Especially when you have commitment from the person at the top. Unfortunately, as you found, there is a whole ecosystem of leadership that needs to be committed—and not only at the beginning, but ongoing.

Anu: Looking back, I think of my vision and plan as a tent, one that didn’t have hooks in the ground, and when the winds came it just blew away.

Angie: It wasn’t grounded fully in the system of people that needed to be transformed. It wasn’t supported with the necessary commitment. That’s a great visual.

Anu: It’s a story I will never forget. A year of wasted time that didn’t lead to any results. However, it was a formative experience for me.

Angie: And you learned things that have made you the stronger leader you are today.

Anu: I learned that this was no small operational change—it was a huge organizational one. And that no change happens in isolation, but instead happens in the context of a situation and the emotions of people involved. Furthermore, that change requires constant communication and validation. Do the stakeholders understand the ramifications of the change? And support it? They may initially, but may not maintain support as the change unfolds. It is important to watch for signals of dissent and address them.

Angie: I like how you point out the systemic nature of transformation, and absolutely agree. Business transformation is all about transforming a system of people. Changes have systemic implications—they are never isolated.

Let’s sum up this tale. We have a great vision, but one that moved into execution without nurturing and validating commitment. It was thwarted by a lack of commitment from other leaders and failed to achieve the desired operating transformation. This is a great tale for others to learn from. Anu, thanks for sharing this with me.

Anu: Absolutely. It was a pleasure to share my experience with you. I am so happy you asked me about this. Every experience in life helps shape you. This was a failure by all counts, but while it was tough then… I loved having experienced it. Because it made me wiser. You know how people say embrace failures … I would put it slightly differently… this was a case of embracing learning, and embracing growth.

Angie: Well said.

-----------------------------------------------------

Order Angie’s book TransformAble: How to Perform Death-Defying Feats of Business Transformation from your favorite bookseller.

Angie Tuglus is a transformation expert and executive advisor. She has led numerous business transformations as a former Fortune 500 executive, and has worked in companies ranging from startup to Fortune 10.

Anu George is a customer focused, global business and digital transformation executive. She has successfully led complex, enterprise-wide transformations, during her tenures at Unilever, GE & Morningstar. An innovative, lateral thinker, Anu’s passion is in helping business leaders and organizations thrive in a rapidly changing world.

-----------------------------------------------------

© 2021 Angie Tuglus

Create a free website with Mobirise